Burden of Rs80 billion transferred to the salaried class

The government accedes to the IMF"s demands and raises the income tax rate to 35 percent for people making more than Rs1 million from 2.5 percent to 2.5 percent.

By raising their tax rates and eliminating the respite that was just declared a short three weeks ago, the government has given in to the International Monetary Fund"s (IMF) demand and transferred the burden of Rs80 billion on the salaried class.

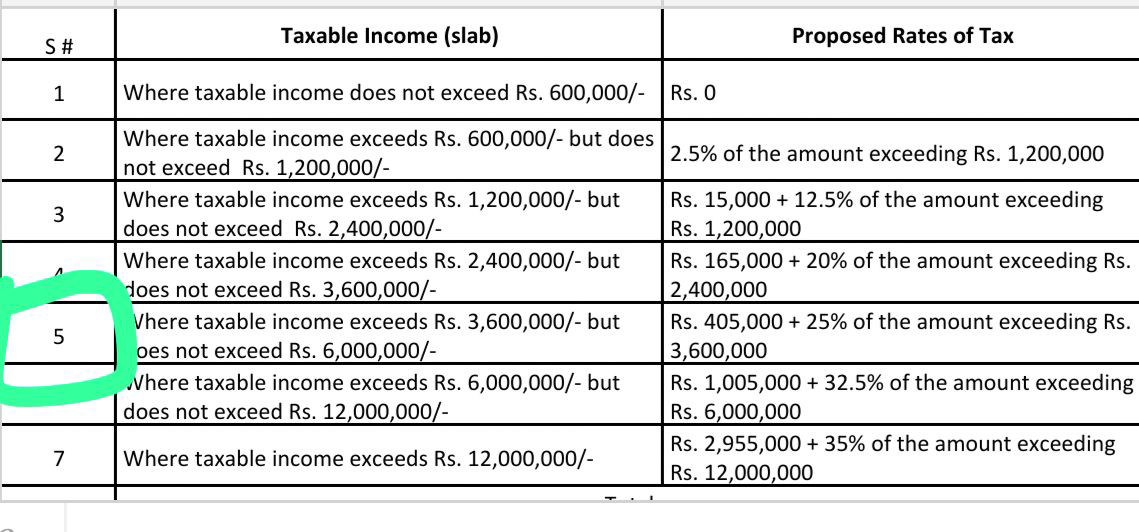

According to the proposed revisions to the Finance Bill 2022, it has established a minimum income tax rate of 2.5 percent for individuals earning up to Rs100,000 per month and a maximum income tax rate of 35 percent on the monthly income of above Rs1 million.

After the IMF refused to bend on its demand, the coalition government reversed its two prior decisions to exempt up to individuals with earnings of Rs100,000 per month from income tax and rolled back its effort to minimize the highest income tax rate from 35 percent to 32.5 percent.

A 47 billion rupee income tax cut for the salaried class was announced by Finance Minister Miftah Ismail on June 10.

The salaried class now faces an additional cost of Rs80 billion from the coalition government, which has not only reversed the respite but also added Rs33 billion in net new taxes since June 2021.

The government rejected the IMF"s proposal to tax the upper middle and affluent income groups—those who make between Rs 104,000 and Rs 1 million per month—at a single rate of 30 percent.

The revised rates are still less than the first request made by the IMF to the previous PTI government.

In order to raise an estimated Rs125 billion from the salaried class, the IMF had sought an unjustifiable rate of 30% to be imposed from people earning between Rs100,000 and Rs1,000,000 per month.

Miftah told The Express Tribune, "We sought to gain as many compromises from the IMF for the salaried class as we could, but it did not entirely accept our position. The net increased impact on the salaried class, he continued, was Rs33 billion annually.

For the tax year 2021, almost 1.24 million salaried individuals submitted income tax forms. 333,000 of them qualify for the monthly income tax exemption of Rs. 50,000. This slab continues to be exempt.

As opposed to the zero tax rate announced on June 10, the government has now suggested a 2.5 percent income tax rate on incomes up to Rs100,000. Even Nevertheless, the rate paid by the salaried class during the previous fiscal year was only half of this.

For those making up to Rs. 200,000 per month, the government has suggested an income tax rate of 12.5%, which is 78 percent higher than the rate announced on June 10. The finance minister had earlier committed not to impose any more burdens on people with monthly incomes of Rs 200,000.

The salary earners paid 10% on incomes up to Rs. 150,000 monthly and 15% on incomes up to Rs. 208,000 monthly for the previous fiscal year.

The government has now set an income tax rate of 20 percent for the fourth tax bracket, which includes people with monthly incomes of up to Rs 300,000, as opposed to the 12.5 percent that was originally proposed on June 10 — a 60 percent increase from the rate that had been in effect for three weeks. For this income bracket, the current tax rate was 17.5 percent.

Pakistan"s inflation this month was 13.8 percent; it is predicted to rise further as a result of other taxing initiatives, including the Rs50 per litre petrol fee.

The government has suggested a 25 percent income tax rate on a monthly income of Rs 500,000, the fifth slab, as opposed to the three-week-old rate of 17.5 percent.

The government has suggested a 32.5 percent rate for anyone making more than Rs1 million per month, up from 22.5 percent three weeks earlier. The tax rate for this category was 25% during the previous fiscal year. However, the IMF had previously suggested a rate of 35% for them. More than 6,000 people make up to Rs 1 million every month.

The government has now suggested a 35 percent income tax rate for those who make over Rs 1 million per month, an increase from the 32.5 percent rate that was in place for the previous three weeks. According to the finance minister, there were only about 12,000 people in the nation who reported having a monthly income of exceeding Rs1 million.

Individuals making between Rs1 million and Rs2.5 million per month were currently subject to a 27.5 percent income tax rate.

Pakistan and the IMF are anticipated to work more closely together as a result of the change in tax rates for the salaried class.

The draught of the Memorandum for Economic and Financial Policies, however, has not yet been made public by the IMF (MEFP).

Either Friday evening or Monday is when the government anticipates receiving the MEFP document.